CEO’S STATEMENT

Customer experience is a key differentiator for Bank Albilad – and has positioned us well for sustainable success.

Ladies and Gentlemen, Bank Albilad Shareholders, Peace be upon you.

The global COVID-19 crisis brought severe disruption to business operations in 2020. Bank Albilad met these challenges head on. Backed by a robust digital infrastructure, we successfully navigated the sudden acceleration and upsurge in the usage of e-channels. Moreover, the Bank’s continued training and development of its agile and highly competent workforce, ensured we swiftly adapted to remote working, achieving excellent operational and financial results.

The government initiatives, policies, and support and together with the guidance from the Saudi Central Bank were crucial in helping us tackle the challenges brought about by the pandemic.

Change is ingrained in our culture. This mindset enabled us to adapt quickly to immediate challenges and threats brought about by the pandemic. More importantly, we did not lose sight of our vision to be the preferred choice of innovative Islamic banking solutions.

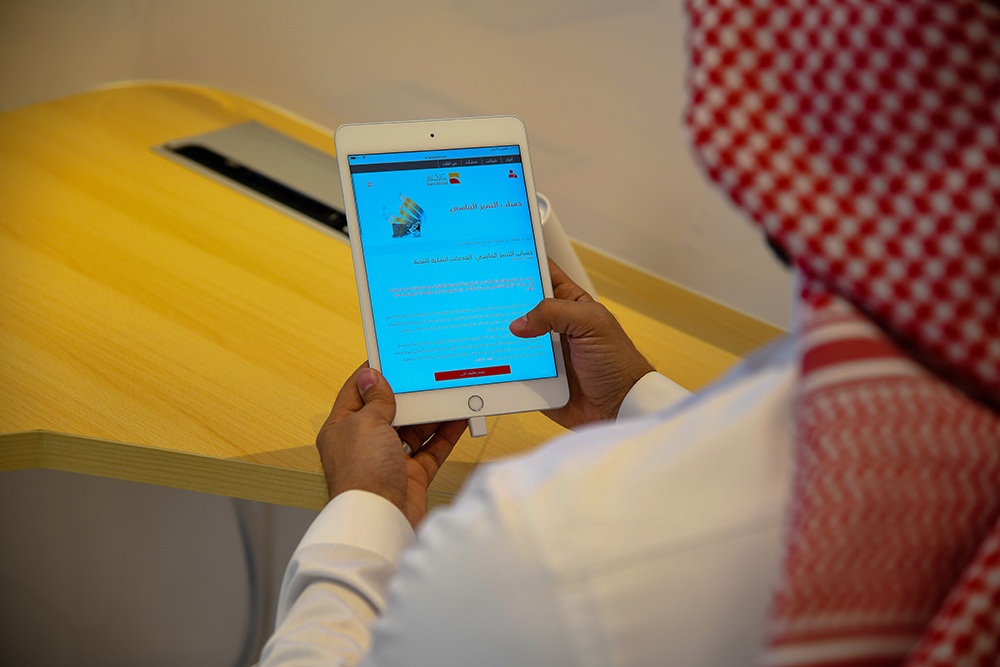

This was a year of continued digital transformation. Bank Albilad solidified its position as an Islamic bank that is breaking new ground through innovation and customer experience while further advancing employee satisfaction.

We steadily gained market share during the year and our business lines performed very well across the board. We successfully captured market opportunities in Treasury and project finance – and our involvement in large transactions helped grow our corporate banking portfolio. The Bank’s Net Income grew 8% to SAR 1,502 million before Zakat, compared to SAR 1,387 million before Zakat the previous year. This was achieved on the back of the growth in Total Operating Income, which improved by 8% to SAR 4,262 million, resulting primarily from the increase in Investing and Financing Income of 17%. The Bank’s Total Assets grew by 11% to SAR 95,744 million, as Investments and Financing expanded by 35% and 18%, respectively while Deposits were up by 7%. We continue to create value for our shareholders, and this is reflected in our Return on Equity after zakat, which reached 13.4%.

CREATING UNPARALLELED CUSTOMER EXPERIENCE

Our customer experience delivery is excellent. Customer experience is a key differentiator for Bank Albilad – and has positioned us well for sustainable success. To continue to deliver on this over the long term, we remain focused on enhancing our customers’ experience. We have done tremendous work in terms of improving the customer journey, which has acquired more business and increased our market share. To this end, we carried out extensive training programs with branch staff in 2020, focusing heavily on augmenting our after-sales service. We committed extra resources to increase capacity in customer social engagement and at our call centers.

Our substantial investment in technology is delivering major benefits to our stakeholders and customers. This has led to a significant improvement in our brand perception. We are delighted to be recognized among the 10 best improved brands in Saudi Arabia in the YouGov Brand Index. Our brand positioning was further cemented with the remarkable response to our special edition National Day Cards. We are reaping the benefits of migrating our business to digital, strengthening our brand and allowing us to capture more market share.

In the process, the Bank has received several awards in the field technology like the Excellence in Innovative Banking Award and Best Mobile Banking Solution Saudi Arabia.

COMMITMENT TO OUR EMPLOYEES

Our employees are the backbone of our business. Having the best and the brightest on board is a key driver of our continued growth. Our people play a critical role in delivering our digital transformation and in 2020 we made considerable progress in equipping them with the skills required for the workplace of the future – and to deliver change more effectively via dedicated technical training programs.

Employee experience and satisfaction is another key focus for the Bank. We have established a reputation for talent development and creating future leaders for the business. During the year, many of our people took advantage of the myriad of courses available at Albilad Academy. We are also embracing new ways of working – and the pandemic accelerated a remote working program that will allow us to tap talents across the Kingdom.

We care for our employees and we want to help them with their future, as much as we can. We provide childcare allowance to our female ambassadors in appreciation of the role they play in balancing children care while carrying out their job responsibilities. We have also launched the Employee Savings Plan (Hafedh) for all our ambassadors.

Our employees are the backbone of our business. Having the best and the brightest on board is a key driver of our continued growth.

We value our employees’ family connections. Prior to the pandemic, we held a very successful Albilad Family Day in February 2020 where around 1,500 family members attended.

SAFEGUARDING CUSTOMER SECURITY

Cyber threats and attacks are major issues for businesses. Cyber security and data protection are therefore of the utmost importance to the Bank – and on which there is no compromise. We take a highly rigid approach to cyber security with multiple resources employed in this area and the very latest in security software.

Another important element of our security is the stability of our digital infrastructure. During the year, we undertook multiple business continuity planning exercises. These involved successful comprehensive recovery tests on all mission-critical IT operations.

UNLOCKING VALUE THROUGH DIVERSIFICATION

Our ability to create value for our stakeholders lies at the heart of our success. We will accomplish this through our strategy to increase market share through organic growth via diversification into new revenue streams. We will also create enhanced product offerings, for a wider choice of advanced and sophisticated Islamic banking solutions.

The regulatory support we receive from the Saudi Central Bank is paving the way for new banking sector opportunities. With solid government backing for SMEs and a major drive towards Saudi home ownership, the Bank is committed to supporting these initiatives. Our current product offerings are well positioned to take advantage of these opportunities. More importantly, the stimulus packages and programs extended by the Saudi Central Bank to the Bank and its customers helped overcome the challenges caused by the pandemic.

Looking further ahead, agent banking will allow us to complement our physical presence in certain locations thus giving the public greater access to banking services. We are poised for the next growth chapter and look forward to finding new opportunities in Treasury and syndication, further expanding our Enjaz remittance business and increasing market share.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

On the ESG front, Bank Albilad continues its engagement in numerous social and environmental initiatives and programs under its Corporate Social Responsibility Program #Albilad_Mubadara supported by the Bank’s ambassadors’ volunteering work, which played a significant role in the success of these initiatives and programs.

Our Head Office building is now partially powered by renewable energy after equipping the building with solar panels, in a way, helping reduce carbon footprint.

A high-quality customer experience extends into the creation of personalized customer propositions. Financial literacy is a significant social responsibility, and in a market first, Bank Albilad initiated savings schemes for education and longterm healthcare for our customers. Our latest initiative with corporates is a savings scheme that will make a direct debit from employees’ salaries.

OUR STAKEHOLDERS

I would like to extend my gratitude to the Board of Directors for their guidance, counsel, and support in the pursuit of our strategic objectives.

My deepest thanks go to our employees for their hard work and contribution throughout the year. I would particularly like to commend the way in which our employees pulled together during the global pandemic; it is their dedication and commitment that ultimately enables us to succeed.

I express my sincerest gratitude to the Custodian of the Two Holy Mosques and the Crown Prince – may Allah protect them – and the Saudi Central Bank for their steadfast support to the national economy and the banking sector.